|

Headlines |

Feb-23 |

Jan-23 |

|

Monthly Index* |

520.7 |

523.0 |

|

Monthly Change* |

-0.5% |

-0.6% |

|

Annual Change |

-1.1% |

1.1% |

|

Average Price (not seasonally adjusted) |

£257,406 |

£258,297 |

* Seasonally adjusted figure (note that monthly % changes are revised when seasonal adjustment factors are re-estimated)

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“Annual house price growth slipped into negative territory for the first time since June 2020, with prices down 1.1% in February compared with the same month last year. Moreover, February saw a further monthly price fall (-0.5%) – the sixth in a row – which leaves prices 3.7% below their August peak (after taking account of seasonal effects).

“The recent run of weak house price data began with the financial market turbulence in response to the mini-Budget at the end of September last year. While financial market conditions normalised some time ago, housing market activity has remained subdued.

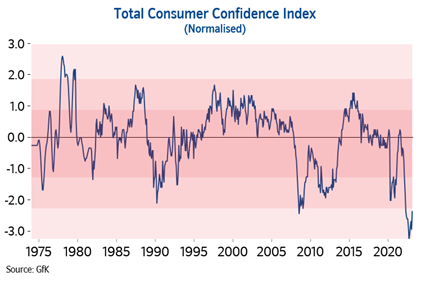

“This likely reflects the lingering impact on confidence as well as the cumulative impact of the financial pressures that have been weighing on households for some time. Indeed, inflation has continued to outpace wage growth and mortgage rates remain significantly higher than the lows recorded in 2021. Even though consumer sentiment has improved in recent months, it is still languishing at levels prevailing during the depths of the financial crisis (see chart above).

Where next?

“It will be hard for the market to regain much momentum in the near term since economic headwinds look set to remain relatively strong, with the labour market widely expected to weaken as the economy shrinks in the quarters ahead, while mortgage rates remain well above the lows prevailing in 2021.

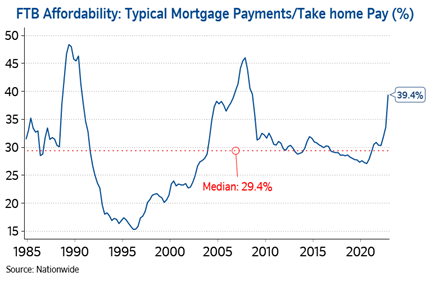

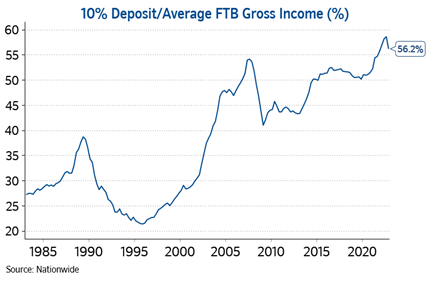

“Indeed, despite the modest fall in house prices, for a prospective first-time buyer earning the average income looking to buy the typical home, mortgage payments remain well above the long run average as a share of take-home pay. In addition, deposit requirements remain prohibitively high for many and saving for a deposit remains a struggle given the rising cost of living, especially for those in the private rented sector, where rents have been rising strongly.

“However, conditions should gradually improve if inflation moderates in the coming months as expected, easing pressure on household budgets. Solid gains in nominal incomes together with weak or declining house prices will also support housing affordability, especially if mortgage rates edge lower in the coming months.”

-ends-