|

Headlines |

Jan-24 |

Dec-23 |

|

Monthly Index* |

521.5 |

517.8 |

|

Monthly Change* |

0.7% |

0.0% |

|

Annual Change |

-0.2% |

-1.8% |

|

Average Price (not seasonally adjusted) |

£257,656 |

£257,443 |

* Seasonally adjusted figure (note that monthly % changes are revised when seasonal adjustment factors are re-estimated)

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

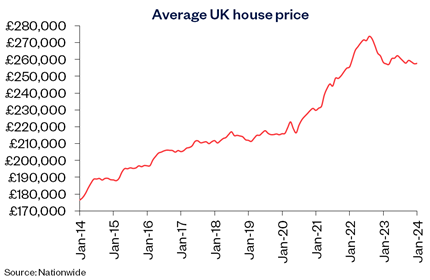

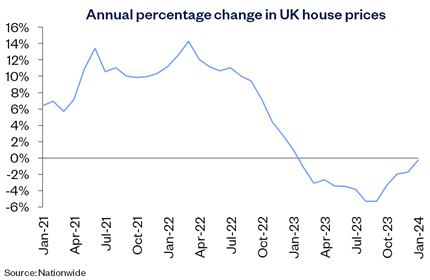

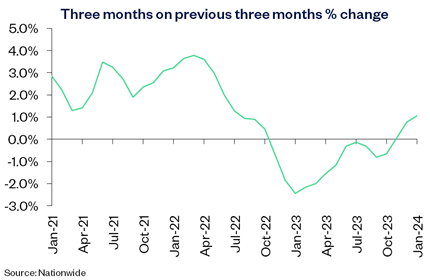

“UK house prices rose by 0.7% in January, after taking account of seasonal effects. This resulted in an improvement in the annual rate of house price growth from -1.8% in December to -0.2% in January, the strongest outturn since January 2023.

Signs of easing in affordability pressures

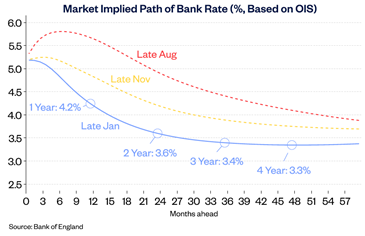

“There have been some encouraging signs for potential buyers recently with mortgage rates continuing to trend down. This follows a shift in view amongst investors around the future path of Bank Rate, with investors becoming more optimistic that the Bank of England will lower rates in the years ahead.

“These shifts are important as this led to a decline in the longer-term interest rates (swap rates) that underpin mortgage pricing around the turn of the year. However, the partial reversal in recent weeks in response to stronger than expected inflation and activity data cautions that the interest rate outlook remains highly uncertain.

“While a rapid rebound in activity or house prices in 2024 appears unlikely, the outlook is looking a little more positive. The most recent RICS survey suggests the decline in new buyer enquiries has halted, while there are tentative signs of a pickup in the number of properties coming onto the market.

“How mortgage rates evolve will be crucial, as affordability pressures were the key factor holding back housing market activity in 2023. Indeed, at the end of 2023, a borrower earning the average UK income and buying a typical first-time buyer property with a 20% deposit had a monthly mortgage payment equivalent to 38% of take-home pay – well above the long run average of 30%.

"If average mortgage rates were to trend down to 4%, this would ease the mortgage payments burden to 34% of take-home pay (assuming house prices and earnings are unchanged). However, other things equal, mortgage rates of 3% (still well above the lows seen in the wake of the pandemic) would be needed to bring this measure of affordability back towards its long run average.

Deposit burden remains significant

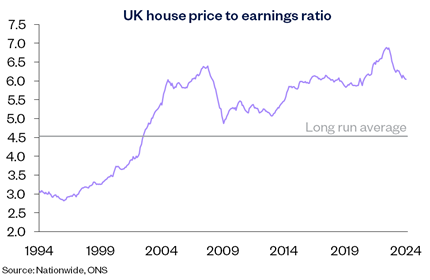

“Raising a deposit also remains a major challenge for those wanting to buy, with a 20% deposit on a typical first-time buyer home equating to c.105% of average annual gross income – down from the all-time high of 116% recorded in 2022, but still close to the pre-financial crisis level of 108%. This reflects that house prices are still very high relative to earnings, with the house price to earnings ratio standing at 5.2 at the end of 2023, well above the long run average of 3.9.

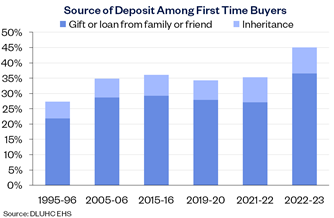

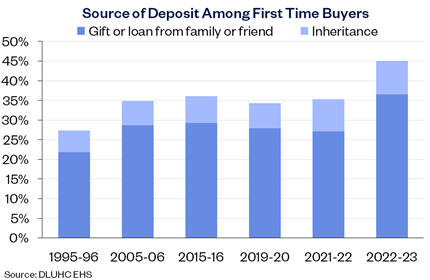

“This helps to explain why the proportion of first-time buyers drawing on help from friends and family or an inheritance to help raise a deposit has increased from already elevated levels as shown on the chart below. In 2022/23, nearly half of first-time buyers had some help raising a deposit, either in the form of a gift or loan from family or friends, or through inheritance – up from 27% in the mid-1990s.

A mixed picture across the UK

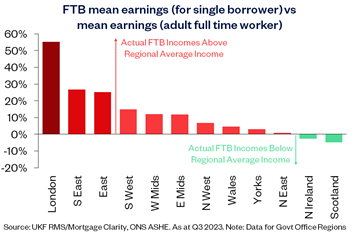

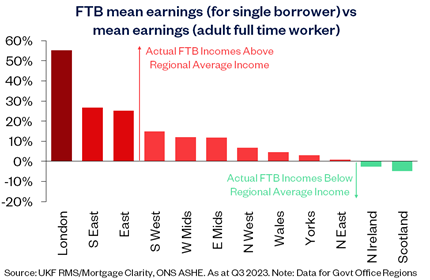

“There remains considerable variation in affordability across the country, with pressures particularly acute in London, the south of England and East Anglia. Scotland and the North continue to be the most affordable regions, with mortgage payments as a share of take-home pay much closer to their long run average.

“These variations have led to stark differences emerging between those who would like to buy and those who are actually able to do so. This is most pronounced in London, where the average income of actual first-time buyers (for a single borrower) is around 55% higher than the average income in the capital (for an adult fulltime worker).

“Similarly, in the South East and East of England, the average income of actual first-time buyers is around 25% above the average income in these regions.

However, in parts of the UK where affordability is less stretched, such as Yorkshire & The Humber and the North East, we find that incomes of actual first-time buyers are broadly similar to average regional incomes. Moreover, in Northern Ireland and Scotland, the average income of first-time buyers is actually slightly lower than average incomes in those regions.”

-ends-