|

Headlines |

Apr-23 |

Mar-23 |

|

Monthly Index* |

518.7 |

516.3 |

|

Monthly Change* |

0.5% |

-0.7% |

|

Annual Change |

-2.7% |

-3.1% |

|

Average Price (not seasonally adjusted) |

£260,441 |

£257,122 |

* Seasonally adjusted figure (note that monthly % changes are revised when seasonal adjustment factors are re-estimated)

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“While annual house price growth remained negative in April at -2.7%, there were tentative signs of a recovery with prices rising by 0.5% during the month (after taking account of seasonal effects). April’s monthly increase follows seven consecutive declines and leaves prices 4% below their August 2022 peak.

“Recent Bank of England data suggests that housing market activity remained subdued in the opening months of 2023, with the number of mortgages approved for house purchase in February nearly 40% below the level prevailing a year ago, and around a third lower than pre-pandemic levels. However, in recent months industry data on mortgage applications point to signs of a pickup.

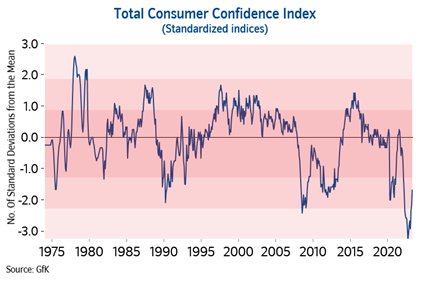

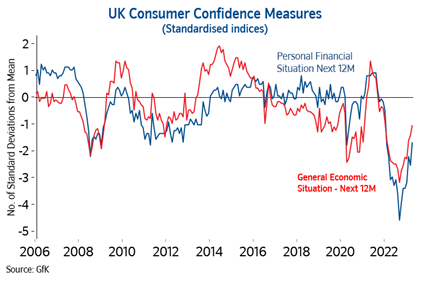

“This also chimes with the recent shifts in consumer sentiment. While confidence remains subdued by historic standards (as shown in the chart below), people’s views of their own financial position over the next twelve months, and general economic conditions in the year ahead, have both improved markedly in recent months. If inflation falls sharply in the second half of the year, as most analysts expect, this would likely further bolster sentiment, especially if labour market conditions remain strong.

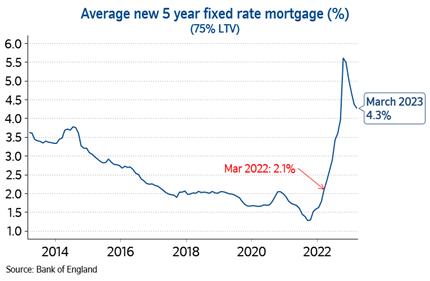

“This, in turn, would also be likely to support a modest recovery in housing market activity. But any upturn is likely to remain fairly pedestrian, as it will take time for household finances to recover, since average earnings have been failing to keep pace with inflation, and by a wide margin over the last few years. Mortgage interest rates are also likely to act as a headwind. While they are well below the highs seen in the wake of the mini-Budget last year, rates are still more than double the level prevailing a year ago (see chart below).

“Nevertheless, if gains in nominal incomes remain solid (wage growth has been running at above 7% in the private sector), this, together with weak or declining house prices, will help improve housing affordability over time, especially if mortgage rates continue to trend lower.”

-ends-