|

Headlines |

Sep-22 |

Aug-22 |

|

Monthly Index* |

542.7 |

542.7 |

|

Monthly Change* |

0.0% |

0.7% |

|

Annual Change |

9.5% |

10.0% |

|

Average Price (not seasonally adjusted) |

£272,259 |

£273,751 |

* Seasonally adjusted figure (note that monthly % changes are revised when seasonal adjustment factors are re-estimated)

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“In September, annual house price growth slowed to single digits for the first time since October last year although, at 9.5%, the pace of increase remained robust. Prices were unchanged over the month from August, after taking account of seasonal effects. This is the first month not to record a sequential rise since July 2021.

“There have been further signs of a slowdown in the market over the past month, with the number of mortgages approved for house purchase remaining below pre-pandemic levels and surveyors reporting a decline in new buyer enquiries. Nevertheless, the slowdown to date has been modest and, combined with a shortage of stock on the market, this has meant that price growth has remained firm.

“By lowering transaction costs, the reduction in stamp duty may provide some support to activity and prices, as will the strength of the labour market, assuming it persists, with the unemployment rate at its lowest level since the early 1970s.

“However, headwinds are growing stronger suggesting the market will slow further in the months ahead. High inflation is exerting significant pressure on household budgets with consumer confidence declining to all-time lows.

“Housing affordability is becoming more stretched. Deposit requirements remain a major barrier, with a 10% deposit on a typical first-time buyer property equivalent to almost 60% of annual gross earnings – an all-time high.

“Moreover, the significant increase in prices in recent years. together with the significant increase in mortgage rates since the start of the year. have pushed the typical mortgage payment as a share of take-home pay well above the long-run average.

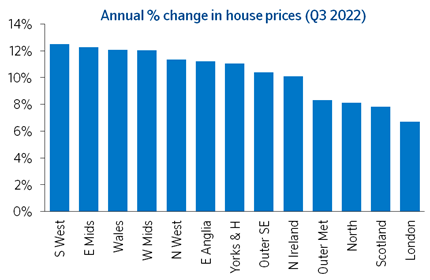

Most regions see further slowing in price growth

“Our regional house price indices are produced quarterly with data for Q3 (the three months to September) showing a softening in annual house price growth in 10 of the UK’s 13 regions (see table on page 4).

“The South West remained the strongest performing region, even though it saw a slowing in annual house price growth to 12.5%, from 14.7% in Q2. This was closely followed by the East Midlands, which saw annual price growth pick up to 12.3%, from 11.4% in the previous quarter.

“Wales saw annual price growth slow to 12.1% but remained the top performing nation. Price growth in Northern Ireland softened to 10.1%. Meanwhile, Scotland saw a further slowdown in annual growth to 7.8%, compared with 9.5% last quarter.

“England saw a further slowing in annual house price growth in Q3 to 9.9%, from 10.7% in Q2. While the South West remained the strongest performing region, southern England continued to see weaker growth overall than northern England.

“Within northern England (which comprises North, North West, Yorkshire & The Humber, East Midlands and West Midlands), the East Midlands was the strongest performing region with price growth picking up to 12.3% year-on-year, from 11.4% in the second quarter.

“London remained the weakest performing UK region, although did see a modest pickup in annual price growth to 6.7%, from 6.0% last quarter.”

Quarterly Regional House Price Statistics (Q3 2022)

Please note that these figures are for the three months to September, therefore will show a different UK average price and annual percentage change to our monthly house price statistics.

Regions over the last 12 months

|

Region |

Average Price (Q3 2022) |

Annual % change this quarter |

Annual % change last quarter |

|

South West |

£321,725 |

12.5% |

14.7% |

|

East Midlands |

£241,699 |

12.3% |

11.4% |

|

Wales |

£213,684 |

12.1% |

13.4% |

|

West Midlands |

£247,120 |

12.0% |

11.8% |

|

North West |

£212,998 |

11.3% |

13.3% |

|

East Anglia |

£289,266 |

11.2% |

14.2% |

|

Yorks & H |

£209,261 |

11.0% |

11.8% |

|

Outer S East |

£353,276 |

10.4% |

11.1% |

|

N Ireland |

£183,960 |

10.1% |

11.0% |

|

Outer Met |

£435,709 |

8.3% |

10.0% |

|

North |

£159,309 |

8.1% |

10.6% |

|

Scotland |

£184,496 |

7.8% |

9.5% |

|

London |

£534,545 |

6.7% |

6.0% |

|

UK |

£273,135 |

10.3% |

11.4% |

UK Fact File (Q3 2022) |

|

|

Quarterly average UK house price |

£273,135 |

|

Annual percentage change |

10.3% |

|

Quarterly change* |

1.3% |

|

Most expensive region |

London |

|

Least expensive region |

North |

|

Strongest annual price change |

South West |

|

Weakest annual price change |

London |

* Seasonally adjusted

Nations – annual & quarterly price change

|

Nation |

Average Price (Q3 2022) |

Annual % change this quarter |

Quarterly % change* |

|

Wales |

£213,684 |

12.1% |

2.5% |

|

N Ireland |

£183,960 |

10.1% |

1.5% |

|

England |

£311,508 |

9.9% |

0.8% |

|

Scotland |

£184,496 |

7.8% |

1.6% |

* Seasonally adjusted

-ends-